Real Estate Portfolio Valuation

Through a collaboration with financial advisor Instituto de Estrategia, I perform financial valuations, generally in connection with corporate finance transactions or tax audits that require an expert opinion on the value of assets, projects and companies.

For this project, we were retained to conduct a financial valuation of two limited liability companies that held real estate portfolios comprising 200 properties including residential, office and industrial real estate valued at more than €20 million.

Our task was to value each company's equity, which we calculated as the market value of the company's assets less the book value of its liabilities. Each company's assets consisted principally in real estate, which we valued according to following methods:

Replacement cost

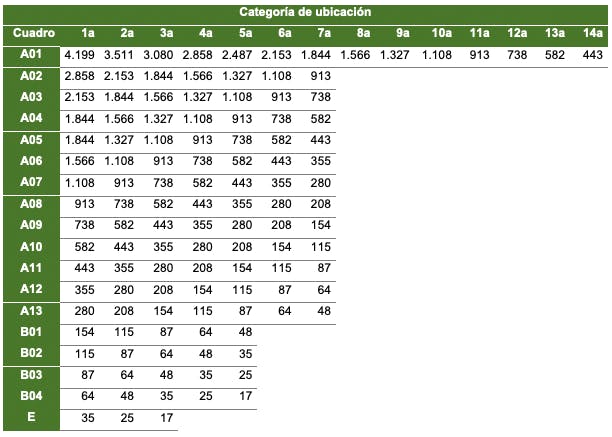

The Catalan tax agency publishes reference values for valuing real estate under a replacement cost method where the value of a property is calculated as the estimated construction cost together with an imputed land cost, which the agency calculates based on data it collects from filings.

The idea here is that an asset's value is equivalent to the cost of replacing it.

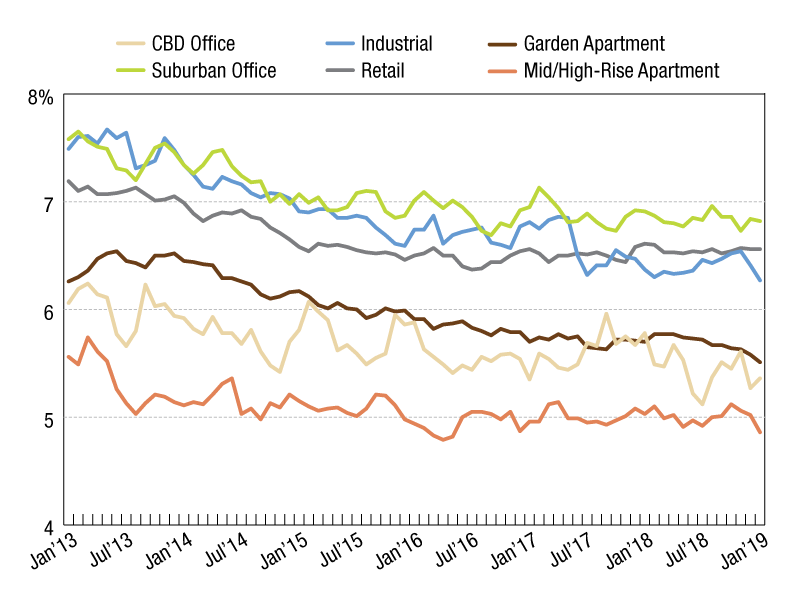

Income approach

As the majority of real estate was leased, we were able to calculate net operating income, i.e. rental income less costs attributable to the lessor (insurance, community association fees, maintenance & repairs, trash service, property tax, etc.), to which we applied cap rates based on the type and location of the asset.

This represents an income approach where the value of the asset is calculated according to the net cash flows it produces.

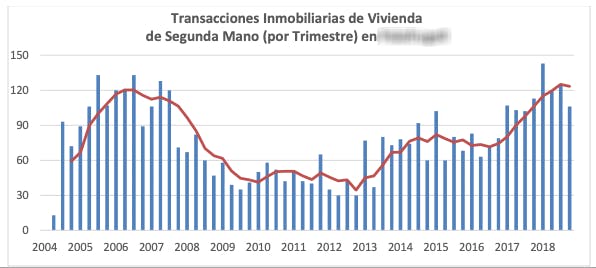

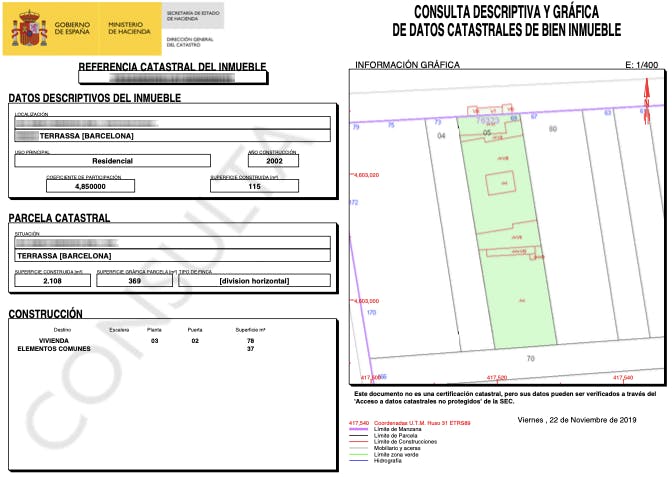

Market value

For each property, we selected comps from listings on platforms such as Idealista, Habitaclia, etc. which featured similar characteristics (location, area, configuration, etc.) with regard to the reference properties. The per square cost for each comparable was homogenized (adjusted) based on its characteristics relative to each reference property (e.g. in better condition, more recent construction, etc.).

This method determines the value of an asset as the market value or price that it would fetch in an arm's length transaction.

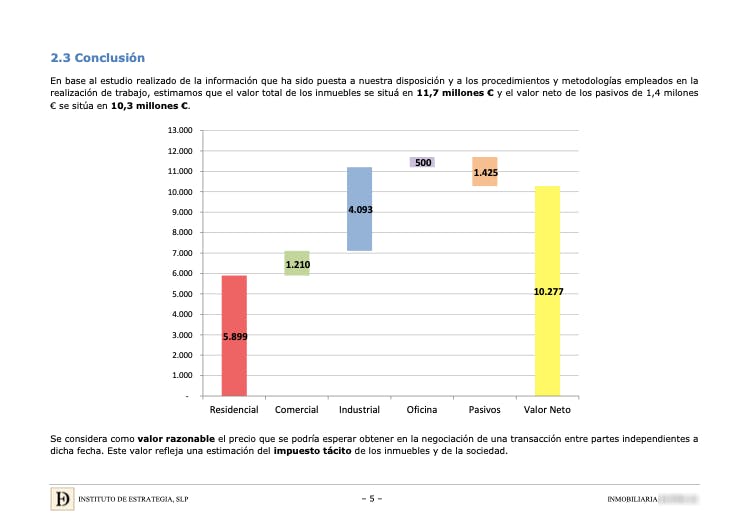

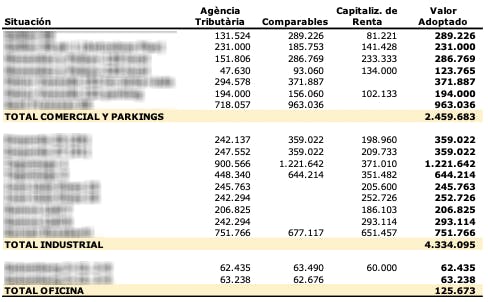

Adopted asset & equity value

The results from these methods were weighted to arrive at the adopted asset valuation. The replacement cost method typically yields a lower valuation vs. those derived from income and market approaches, and therefore served as the valuation floor.

Finally, we incorporated tax adjustments (implicit capital gains) and subtracted the book value of the company's liabilities to arrive at the market net asset value of each company's equity.

Team

Given the broad scope of the mandate and tight timeframe, we recruited additional team members, including architects, accounting and tax professionals, designers and administrative assistants, to complete the project. In the end, I led a team of eight people working over several months – and more than a few late nights – to complete the project.

Sources of information

In addition to the documentation provided by our client, we obtained information from the Spanish property registry, national tax database (Catastro), statistics agencies and various municipalities.

Valuation report

The valuation report included an analysis of the company's financial statements, description of assets, overview of geographic regions and municipalities, financial valuation of the assets and company equity, as well as profiles on each property and relevant comps.

The final report, spreadsheet results, appendix and supporting documentation were provided to the client and attorneys in hardcopy and via shared Google Drive.